When Does a Mortgage Refinance Make Sense?

When interest rates decline, mortgage refinancing becomes a particularly popular topic. However, there are several other good reasons for your clients to consider refinancing, including an increase in their credit score or home value, or the availability of more favorable loan terms. Each client’s situation is unique, and many factors must be considered before making the decision to refinance.

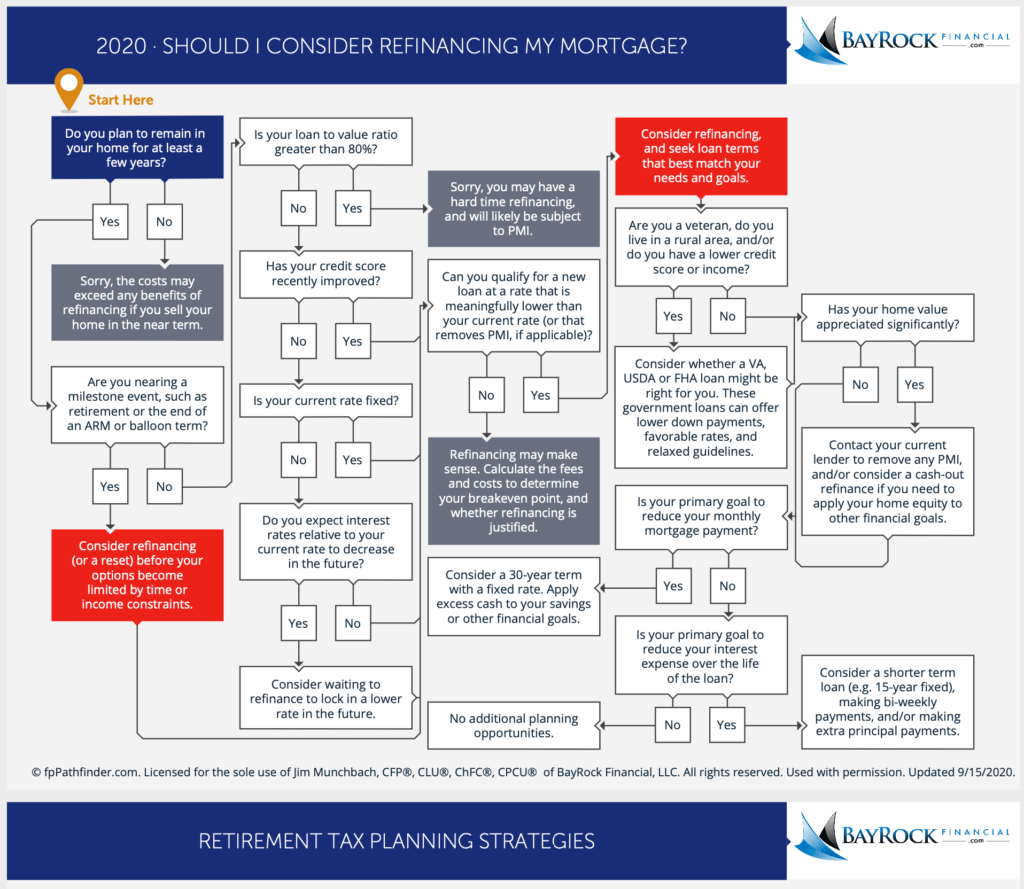

Our Mortgage Refinance Flowchart helps guide your conversations when advising clients about their mortgages. The Mortgage Refinance Flowchart covers:

-

Interest rate trends

-

Current loan rates and terms

-

Available alternatives

-

Motivations for refinancing

-

Cautions against refinancing

Interest rate trends

With today’s historic low rates, many clients are thinking about a Mortgage Refinance to lower their monthly interest expense. But is it the right time for a Mortgage Refinance for your clients? Homeowners refinance for many reasons, including changes in their financial situation or a change in long-term goals. While a Mortgage Refinance might be a good idea for some clients, it doesn’t mean that it’s the right time for everyone.

So how can your client tell if it’s the right time for a Mortgage Refinance?

Current loan rates and terms

The Term of the Loan

Your client may have an original loan term of 15, 20, or 30 years, for example. The most common length of time for a mortgage loan is 30 years.

Loan term remaining:

If your client continues to make the scheduled payments on the current loan, when will it be paid off? Does your client want to pay off their loan faster? Or would they like more time to pay off the loan with lower payments?

Their Current Interest Rate:

The latest statement from your client’s lender should tell them the rate they’re paying now. If their interest rate is 0.75% or higher than today’s lowest rates, your client may want to consider a Mortgage Refinance. Even an interest rate difference of one-half of 1% can make a big difference in their total interest expense, assuming your client intends to stay in their home for more than a few years.

Available Alternatives

If your client has a low rate, but it’s on a variable-rate mortgage, they could face much higher interest expenses and monthly mortgage payments when rates begin to rise. Fixed and variable rate mortgages have similar rates now and those rates probably won’t go much lower. Rates are likely to rise from these current lows. Now may be be a good time to take advantage of the opportunity to lock in a low, fixed-rate for the duration of your client’s mortgage.

Motivations for Mortgage Refinance

Cha Cha Cha Changes…

A Mortgage Refinance may help your client if they’ve experienced any of these changes:

Change in Interest Rates

As interest rates have edged lower and lower, your client may have already done a Mortgage Refinance in the last 12months. The most compelling reason for refinancing a mortgage is to get a lower interest rate and save on the interest expense over the life of the loan.

Change in Career or Income

Your financing needs to change with your income level and job security. For example, if your income and credit history have improved since your client purchased your home, your client may qualify for a more favorable loan now. With increased income, your client might choose to refinance with a shorter term loan, such as a 15-year loan. On the other hand, if your client’re facing financial stress, your client may want to refinance with a longer term loan to minimize your monthly payments.

### Family Changes

Marriage, divorce, or other major family changes can affect how much your client can afford to pay in mortgage payments. For example, if your partner has passed away, your client may be having difficulty making your current payments. A longer term loan, perhaps at a lower interest rate, can make staying in your home more affordable.

Change in Financial Situation

Your client may want to refinance because of other financial changes like an inheritance or other windfall. This change may be the perfect opportunity for a Mortgage Refinance while paying down their mortgage.

Homeowners can generally make extra payments on their mortgage principal without doing a Mortgage Refinance. However, making extra payments does not reduce the monthly payments. If your client is paying off a significant percentage of their mortgage, they may want to take out a new mortgage. With a lower principal amount and possibly a lower interest rate, their new monthly payment could be considerably lower.

Change of Mind

Other financial changes, such as deciding they want to retire early and wanting the mortgage paid off is another change to consider.

Getting Rid of PMI

If your client purchased a home with less than 20% down, they may still be paying private mortgage insurance (PMI). Your client may be able to get rid of PMI without a Mortgage Refinance. However, refinancing to get rid of PMI is often a good idea, especially if your client gets a lower interest rate in the process. If your client is able to get a new loan with no PMI it either means their home went up in value or they’ve been paying down their balance, or both.

Wanting to Tap Into Home Equity

The difference between the home’s value and the mortgage balance is home equity. By taking out a larger new mortgage than the current mortgage, your client can take equity from their home and put money in their pocket or use it for other purposes.

Doing a Mortgage Refinance to take out home equity got a bad name when homeowners repeatedly refinanced their homes before the recession before the Great Financial Crisis. Homeowners found themselves underwater when real estate prices fell dramatically. It could happen again. That doesn’t mean utilizing home equity is always a bad idea. Taking equity from their home to make a purchase or pay off higher interest debt can be part of a wise, long-term financial plan, especially when the interest rate on new mortgage is lower than other sources of financing.

Bottom Line

Our Mortgage Refinance Flowchart can help you help your client make a wise decision about whether or not to consider a Mortgage Refinance now or in the future.

As always, we would love to hear your thoughts about our Mortgage Refinance Flowchart and any of the topics discussed in this week’s post:

-

Interest rate trends

-

Current loan rates and terms

-

Available alternatives

-

Motivations for refinancing

-

Cautions against refinancing